The enterprise software landscape is approaching a fundamental transformation that will reshape how businesses operate, integrate, and scale their digital operations. Today’s reality of managing 130+ disparate saas tools across the average enterprise is rapidly giving way to a new paradigm of intelligent, unified platforms that promise to eliminate the chaos of software sprawl while delivering unprecedented operational efficiency. SaaS applications such as Google Workspace and Salesforce CRM rely on cloud infrastructure for scalability and efficiency, in contrast to traditional local installations that lack this flexibility and performance.

The future of saas platforms and integrations is being driven by three converging forces that will fundamentally alter the software landscape by 2026: native AI adoption across all platforms, aggressive consolidation ending the point solution era, and the emergence of unified integration architectures that seamlessly connect business processes. These changes aren’t incremental improvements—they represent a complete reimagining of how saas solutions will be built, delivered, and consumed. Future SaaS trends include deeply integrated, AI-powered platforms offering hyper-personalization, vertical specialization, usage-based pricing, enhanced security, and Low-Code/No-Code development. The future will focus on smarter, specialized, and autonomous SaaS that delivers personalized value while managing complexity and costs.

Market projections underscore the magnitude of this transformation. The saas market is expected to reach $1.1 trillion by 2032, while the integration platforms market will hit $15 billion by 2025, reflecting a steady CAGR exceeding 20% since 2020. Cloud services play a critical role in supporting this SaaS market growth and are essential components of modern cloud computing solutions, enabling secure data management and industry-specific applications. The evolving SaaS landscape is being shaped by trends such as AI, security, and industry-specific solutions, which are redefining the way businesses leverage software. The SaaS integration market is projected to surpass $15 billion in annual revenue by 2025, reflecting a steady CAGR exceeding 20% since 2020. More importantly, businesses will transition from managing fragmented tool portfolios to orchestrating integrated platform ecosystems that automate processes across entire value chains, enabling businesses to focus on strategic growth rather than software maintenance. However, the average annual SaaS app price increase of around 8.7% often outpaces IT budget growth, adding financial pressure to these transitions. The SaaS integration market’s growth highlights the increasing reliance on seamless connectivity to drive operational efficiency and innovation. SaaS platforms and integrations are transforming business operations across various industries, demonstrating their broad applicability and impact in diverse business contexts.

Table of Contents

ToggleThe Transformation Landscape: What’s Coming by 2026

The current enterprise software environment represents a transitional moment between two fundamentally different approaches to business technology. While organizations today struggle with integration challenges across dozens of specialized saas applications, the emerging landscape will center on comprehensive platforms that combine multiple capabilities within unified, AI-driven environments. Modular software connected via APIs—application programming interfaces that enable third-party connections between SaaS products—will enhance agility and scalability in SaaS applications, enabling businesses to adapt more quickly to changing needs. The integration process, especially when relying on APIs, presents challenges in maintaining and updating compatibility as APIs evolve, requiring ongoing attention to ensure seamless connections. AI will further improve integrations by automating data mapping and enabling natural language configuration of setups, simplifying complex processes and reducing manual effort.

This shift from point solutions to platform ecosystems reflects several underlying market dynamics. saas vendors are recognizing that customer success increasingly depends on seamless integration between tools rather than individual feature sophistication. Meanwhile, enterprises are demanding solutions that reduce complexity rather than add to it, driving preference for platforms that can replace multiple point solutions without sacrificing functionality. The increasingly competitive SaaS market is also driving consolidation among companies to offer integrated value and greater functionality. Machine Learning (ML), a subset of AI, is being utilized in SaaS to automate customer service reports and applications, further enhancing operational efficiency and customer satisfaction.

The statistical evidence supporting this transformation is compelling. Research indicates that 90% of enterprises will adopt unified APIs or embedded integration platforms by 2025, while 40% of enterprise saas will include outcome-based pricing models by 2026. These numbers reflect fundamental changes in how saas companies build products and how customers evaluate software investments. AI’s integration into SaaS is also leading to significant changes in pricing structures, impacting budgets and negotiations as organizations adapt to these new models. The widespread adoption of unified APIs and embedded platforms underscores the growing importance of seamless integration in modern business operations. To ensure comprehensive integration coverage, it is crucial to understand different data formats such as XML, CSV, and JSON, as well as various API types like REST, SOAP, and GraphQL, since these factors impact how SaaS products communicate and exchange information. By 2025, 90% of enterprises will leverage either a Unified API or embedded iPaaS solution to manage their cloud integrations, further emphasizing the critical role of integration in the SaaS ecosystem.

Perhaps most significantly, the role of integration is evolving from a technical afterthought to a core product differentiator. saas providers understand that seamless integration capabilities now determine competitive advantages, customer satisfaction, and retention rates more than individual features or pricing strategies.

The Rise of Native-AI SaaS Platforms

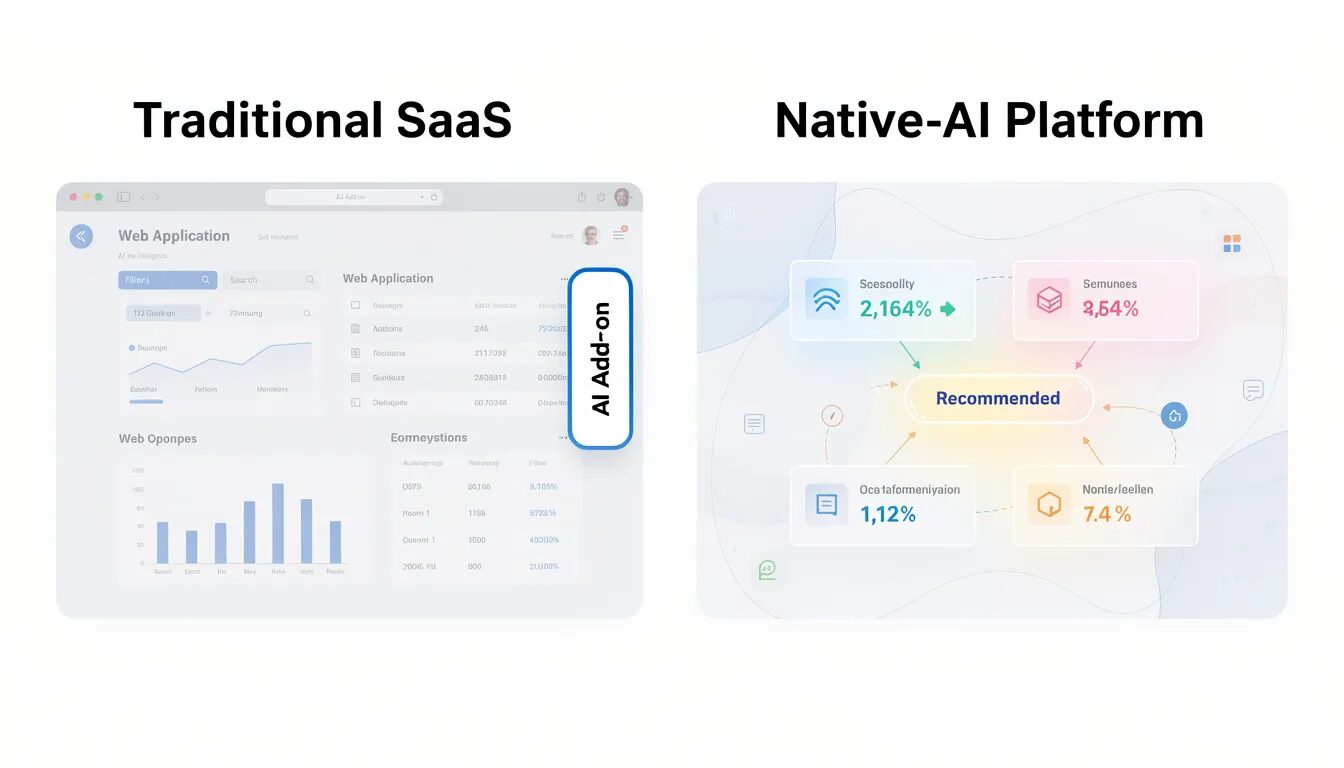

The evolution from traditional saas to AI-enabled to native-AI architectures represents one of the most significant developments shaping the future of saas platforms. While current AI implementations typically add intelligence features to existing software frameworks, native-AI platforms are being built from the ground up with artificial intelligence as the foundational layer rather than an add-on capability. Ai enabled saas platforms are leveraging advanced AI features to drive new pricing models, such as usage-based and hybrid strategies, and to improve cost management through automated billing and resource optimization.

Native-AI platforms differ fundamentally from traditional saas solutions in their approach to data processing, user interaction, and workflow automation. Instead of requiring users to manually configure processes and interpret results, these platforms continuously learn from user behavior and business context to automatically optimize operations, suggest actions, and execute routine tasks without human intervention. The integration of AI in SaaS platforms is expected to enhance decision-making processes by providing actionable insights from large data sets.

The impact on product development is already visible across major saas providers. Salesforce’s Einstein GPT, Microsoft’s Copilot integration across 365 platforms, and ServiceNow’s Now Intelligence demonstrate how established platforms are transitioning toward AI-native architectures. The growing integration of generative ai into SaaS applications is driving advancements in content creation, automation, and product enhancement, reshaping industry trends and expanding the capabilities of SaaS solutions. By 2026, computational intelligence will become the primary interface for most business software interactions, fundamentally changing how users engage with saas tools. AI agents will automate a range of routine tasks, enhancing efficiency in SaaS through intelligent automation. Predictive analytics in SaaS will also help forecast market trends and provide actionable business intelligence, enabling organizations to make more informed decisions and stay ahead of industry shifts.

Data processing capabilities within native-AI platforms enable real-time analysis and response across integrated systems. Rather than generating reports for human review, these platforms automatically identify patterns, anomalies, and opportunities within data flows, triggering appropriate actions across connected saas applications. This transformation promises to eliminate much of the manual work currently required to manage multiple saas applications effectively.

AI Agents and Horizontal Platform Evolution

AI agents represent the next evolution of platform integration, enabling horizontal scalability while providing vertical specialization across diverse business functions. These intelligent agents operate as autonomous software entities capable of managing workflows, negotiating between systems, and optimizing resource allocation across multiple platforms without requiring constant human oversight.

The role of AI agents in transforming established platforms like Salesforce, ServiceNow, and Microsoft 365 extends beyond simple automation. These agents develop contextual understanding of business processes, customer relationships, and operational patterns that create sustainable competitive advantages through accumulated learning and optimization. Organizations implementing AI agent architectures report significant improvements in workflow efficiency and decision-making speed.

Contextual richness and data moats emerge as critical competitive advantages in AI-agent-enabled platforms. As agents accumulate knowledge about specific business contexts, industry patterns, and organizational preferences, they become increasingly valuable and difficult to replace. This dynamic encourages longer-term platform relationships and reduces the likelihood of customers switching between competing saas solutions.

Predictions for AI agent integration across CRM, ERP, and collaboration platforms suggest that by 2027, most enterprise software interactions will be mediated by intelligent agents capable of understanding natural language requests, executing complex workflows, and coordinating actions across multiple integrated systems. This evolution will fundamentally change how businesses evaluate and implement saas solutions.

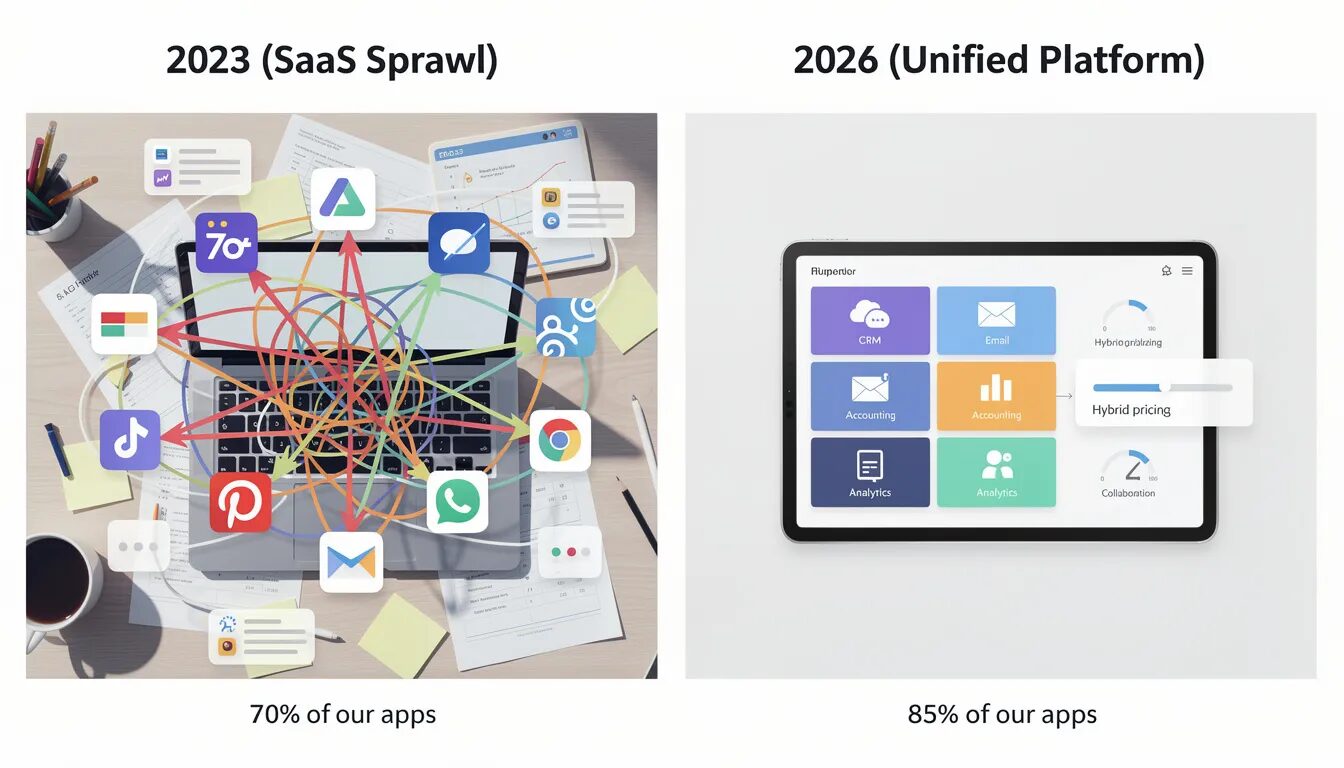

Platform Consolidation and the End of Point Solutions

The point solution era that has dominated saas development for the past decade is approaching its conclusion as businesses recognize the operational costs and complexity associated with managing extensive tool portfolios. By 2026, unified platforms offering seamless component integration will dominate enterprise software acquisition decisions, driven by demands for operational efficiency and reduced maintenance overhead. Companies estimate that 70% of apps they use are SaaS-based, which will increase to 85% by 2025. The shift to hybrid pricing combines fixed subscription fees with variable usage charges, offering businesses more flexibility and alignment with their actual software usage. The SaaS model is now seen not just as a method of software delivery, but as a strategic business approach that is evolving with new technologies and practices such as AI, security, and advanced integrations.

Platform consolidation strategies focus on creating comprehensive environments that eliminate the need for separate tools while maintaining specialized functionality through integrated modules. This approach addresses the core challenge of saas sprawl: the exponential increase in integration complexity as organizations add more point solutions to their technology stacks. SaaS solutions are also streamlining various business models, particularly in industries like construction, by enabling more adaptable and efficient software distribution and operations.

The emergence of saas superapps with unified apis and integrated mini-applications represents a fundamental shift in software architecture. Rather than building standalone applications that require complex integration, leading saas companies are developing platform ecosystems that support multiple business functions within unified environments. Examples include HubSpot’s expansion from marketing automation to comprehensive CRM and customer service, and Notion’s evolution from note-taking to complete workspace management. Superapps will consolidate multiple functions, such as CRM and marketing, into single interfaces to reduce app overload. Integrated platforms enable better management and service of both potential and existing customers by improving data sharing and touchpoints across the customer journey.

Successful platform consolidation strategies demonstrate clear market advantages. Organizations report significant reductions in training costs, support complexity, and security management overhead when consolidating from multiple point solutions to integrated platforms. Additionally, data consistency and workflow automation become dramatically more effective when multiple business functions operate within shared platforms. Robust SaaS integrations can lead to a 40% increase in user engagement for SaaS companies offering native integrations.

Vertical SaaS and Micro-SaaS Integration

The growth of industry-specific solutions in healthcare, construction, and finance reflects increasing demand for specialized functionality that generic horizontal platforms cannot efficiently provide. Vertical SaaS solutions offer deep domain expertise, built-in compliance capabilities, and industry-specific workflows that create significant value for specialized businesses. HR platforms are a prime example, as integrating various HR systems like Greenhouse can streamline onboarding processes, improve collaboration, and automate workflows, ultimately enhancing employee experience and operational efficiency.

Healthcare vertical SaaS platforms integrate patient scheduling, billing, telehealth, and regulatory reporting within unified environments optimized for clinical workflows. Construction industry platforms combine project management, resource planning, compliance tracking, and financial management tailored to construction-specific requirements. These specialized platforms demonstrate how vertical focus can create superior user experiences compared to generic alternatives. The construction industry will continue to embrace the benefits of micro-SaaS in 2025 as more purpose-built solutions arise to improve construction safety management, efficiency, and profitability.

Micro SaaS solutions are integrating into broader platform ecosystems rather than remaining isolated point solutions. A micro SaaS product is a niche-focused, lightweight software solution that addresses specific pain points within broader SaaS ecosystems. This trend enables specialized functionality to exist within larger platforms while maintaining the focused development approach that makes micro SaaS effective. Documenting workflows, data mappings, and API endpoints is essential for maintaining effective SaaS integrations, ensuring that these micro solutions can seamlessly operate within larger ecosystems. Micro-SaaS products are generally easier and faster to create, test, and release since the feature sets are smaller and more targeted, allowing for rapid innovation and deployment. However, Micro-SaaS products are geared towards a very specialized niche, which can limit their lifespan as industry trends change. Tailored solutions are designed to meet the specific needs of particular industries or niche functions, improving efficiency and workflow. Micro-SaaS focuses on addressing specific pain points within broader SaaS ecosystems.

White label SaaS expansion in fintech and e-commerce sectors enables platform providers to offer specialized capabilities without developing internal expertise in complex domains like payments, lending, or regulatory compliance. This approach allows platforms to provide comprehensive functionality while leveraging specialized providers for domain-specific requirements, creating more robust overall solutions for end users. The rise of white-label SaaS solutions is expected to grow significantly, allowing companies to rebrand and resell software under their names.

The Integration Revolution: iPaaS and Unified APIs

The evolution from traditional API integrations to embedded iPaaS solutions represents a fundamental shift in how saas applications connect and share data. While historical integration approaches required custom development and ongoing maintenance, modern embedded integration platforms enable seamless connectivity with minimal technical overhead, making sophisticated integrations accessible to organizations without extensive development resources. Seamless connection between applications is now critical for business efficiency, as it allows effortless communication and data exchange across multiple systems. By 2025, the iPaaS market is expected to grow exponentially, generating $9 billion in revenue, as businesses increasingly adopt these solutions to manage their cloud integrations.

The projection that 90% of enterprises will adopt unified apis or embedded iPaaS solutions by 2025 reflects recognition that integration capabilities have become essential infrastructure rather than optional enhancements. Organizations implementing unified API strategies report significant reductions in integration development time, maintenance costs, and technical complexity compared to traditional point-to-point integration approaches.

Integration market growth from the current $15 billion to a projected $25 billion by 2030 underscores the strategic importance businesses place on seamless connectivity between saas applications. This investment reflects understanding that integration capabilities often determine the overall value organizations derive from their software investments more than individual application features.

Real-world examples demonstrate the competitive advantages of comprehensive integration capabilities. Slack’s ecosystem of over 2400 integrations enables users to access functionality from numerous other platforms without leaving their primary communication environment. Similarly, Shopify’s 5800+ integrations allow e-commerce businesses to connect virtually any business function—from accounting to inventory management to marketing automation—within their e-commerce platform. Integration of payment processors is a critical component, enabling secure and seamless transactions in e-commerce SaaS apps. These integrations support a wide variety of SaaS apps, each with unique architecture and deployment models, further enhancing the flexibility and scalability of the platform.

Event-Driven Architecture and Real-Time Data Exchange

The shift toward API-first designs and event-driven integration patterns enables real-time responsiveness across connected saas applications, eliminating the delays and inconsistencies associated with traditional batch integration approaches. Event-driven architectures allow systems to react instantly to changes in other platforms, creating seamless user experiences and enabling automated workflows that span multiple applications.

Real-time data synchronization significantly impacts business decision-making by providing immediate access to complete, current information across all connected systems. Organizations implementing event-driven integration architectures report improved decision-making speed, reduced errors from data inconsistencies, and enhanced customer experience through coordinated actions across multiple touchpoints.

Technical infrastructure requirements for seamless multi-app workflows include robust message queuing systems, reliable event schema management, and sophisticated error handling and recovery mechanisms. These requirements are driving adoption of cloud-native integration platforms that provide the scalability and reliability necessary for real-time, multi-application coordination.

Edge computing enhancements are improving integration performance and reliability by processing integration logic closer to data sources and end users. This approach reduces latency, improves response times, and provides better resilience against network connectivity issues that can disrupt cloud-based integration processes.

Pricing Model Revolution: From Seats to Outcomes

The transition from traditional per-seat pricing to usage-based and outcome-based pricing models reflects fundamental changes in how organizations consume and value saas solutions. Usage-based pricing aligns costs with actual value received, while outcome-based pricing ties software costs directly to business results achieved through the platform. Additionally, SaaS pricing models are evolving due to the influence of AI and usage-based pricing, which are reshaping how costs are structured and negotiated.

Statistics showing that 80% of customers prefer usage-based pricing demonstrate strong market demand for pricing alignment with value received. This preference reflects frustration with traditional seat-based pricing that often results in paying for unused capacity or constrains growth due to per-user cost concerns. Usage-based models enable organizations to scale software consumption naturally with business growth.

Gartner’s prediction that 40% of enterprise saas will include outcome-based pricing by 2026 indicates a fundamental shift toward value-based software relationships. Outcome-based pricing requires saas providers to demonstrate measurable business impact, encouraging focus on customer success and long-term value creation rather than feature proliferation. This represents a significant increase from just 15% a few years ago, highlighting the rapid adoption of this pricing model.

AI’s role in driving consumption-based models stems from the variable computational costs associated with AI processing. AI features typically require significant processing resources that vary dramatically based on usage patterns, making traditional flat-rate pricing economically unsustainable. This dynamic is encouraging adoption of consumption-based pricing models that align costs with actual resource utilization.

Hybrid Pricing and Contract Negotiation Strategies

The rise of hybrid models combining fixed base fees with variable usage charges provides predictable cost foundations while enabling usage-based scaling. These models typically include core platform access at fixed rates with additional charges for consumption-based features like AI processing, data storage, or transaction volumes.

The impact of AI add-ons increasing base costs by 30-110% requires organizations to carefully evaluate the business value of AI features relative to their cost implications. Early adopters report that AI capabilities often justify their additional costs through productivity improvements and enhanced decision-making, but organizations must develop frameworks for measuring and validating these benefits.

Negotiation tactics for price caps, volume thresholds, and overage limits become critical as organizations adopt usage-based pricing models. Effective strategies include establishing maximum spending limits, negotiating volume discounts for anticipated usage levels, and implementing monitoring systems to track consumption patterns and prevent unexpected costs.

Financial planning strategies for volatile consumption-based pricing require sophisticated budgeting approaches that account for usage variability while maintaining cost predictability. Organizations implementing usage-based saas solutions report success with flexible budgeting models that establish baseline costs for core functionality while creating contingency capacity for variable consumption.

Enhanced Security and Compliance Framework

The evolution toward zero-trust architectures across saas ecosystems reflects recognition that traditional perimeter-based security models are inadequate for protecting data and processes distributed across multiple cloud platforms. Zero-trust approaches assume no implicit trust within the system and require verification for every access request, regardless of source location or previous authentication status. Managing, analyzing, and securing customer data is critical in this context, as it drives personalization, enhances security, and provides operational insights within SaaS offerings.

AI-driven threat detection and vulnerability management integration provides continuous monitoring and automated response capabilities that traditional security approaches cannot match. These systems analyze patterns across multiple saas platforms to identify potential security threats, configuration drift, and compliance violations before they result in incidents.

Regulatory compliance automation for GDPR, CCPA, SOC 2, and HIPAA enables organizations to maintain compliance across complex saas ecosystems without extensive manual oversight. Automated compliance tools monitor data flows, access patterns, and configuration settings to ensure ongoing adherence to regulatory requirements across all connected platforms.

Shadow IT mitigation becomes increasingly important as AI-powered saas adoption accelerates and employees gain access to powerful tools that may not be formally approved by IT departments. Organizations are implementing saas management platforms that provide visibility into all cloud applications in use while enabling controlled access to approved alternatives that meet security and compliance requirements.

SaaS Security Posture Management (SSPM)

The growth of automated security tools addressing saas misconfigurations reflects increasing recognition that security vulnerabilities often result from improper configuration rather than software defects. SSPM solutions continuously monitor saas application settings to identify potential security risks and recommend remediation actions. Security will also be prioritized with measures such as zero-trust security models and AI-driven threat detection embedded in platforms, ensuring robust protection against evolving threats. Enhanced security will be essential for SaaS as threats rise and regulations become stricter, driving the need for more advanced and proactive security measures. The demand for enhanced SaaS security will become a top priority for vendors and organizations in 2025, driven by increased cyber threats and regulatory compliance.

Real-time monitoring of data flows across integrated platforms enables immediate detection of unusual access patterns, unexpected data movements, or potential security breaches. These monitoring capabilities become particularly important in integrated environments where security incidents in one platform can potentially impact connected systems.

Identity and Access Management (IAM) evolution addresses the complexity of managing user permissions and access rights across multiple interconnected saas platforms. Modern IAM solutions provide centralized control over user access while supporting the granular permission requirements of individual platforms within integrated ecosystems. SaaS integration opens doors for shadow SaaS, misconfigured apps, and rogue insider access, necessitating proper controls to mitigate these risks and ensure secure operations.

Compliance governance frameworks for AI-powered applications address the unique challenges of managing regulatory compliance in systems that continuously learn and adapt their behavior. These frameworks establish monitoring and control mechanisms that ensure AI-driven decisions remain within compliance boundaries while enabling the flexibility necessary for effective AI operation.

Emerging Technologies Reshaping SaaS Delivery

Low-code/no-code platform acceleration is enabling citizen developers throughout organizations to create custom applications and automations without extensive programming knowledge. These platforms often feature visual interfaces that allow users to build applications by dragging and dropping components, simplifying system integration and making it easier for business users without programming expertise to participate. This democratization of software development is reducing dependence on technical teams while enabling faster response to business needs and more personalized software solutions. SaaS companies are increasingly adopting these platforms to empower non-technical employees to build and customize software, further driving innovation and efficiency.

Edge computing brings processing capabilities closer to users and data sources, improving performance and enabling more sophisticated local processing capabilities. For saas applications, edge computing enables better response times, enhanced offline capabilities, and more efficient handling of data-intensive operations like AI processing and real-time analytics.

Data-as-a-Service (DaaS) expansion integrates with AI and edge computing to provide sophisticated data processing and analysis capabilities as standardized services. DaaS platforms enable organizations to access advanced analytics and AI capabilities without developing internal expertise, democratizing access to sophisticated data processing technologies.

Sustainability and ESG initiatives are becoming integral to saas operations as organizations increasingly prioritize environmental responsibility and social impact in their software selection criteria. saas providers are developing carbon-neutral platforms, implementing sustainable development practices, and providing tools to help customers track and reduce their environmental impact. Sustainability practices like green data centers and carbon offsets will become key differentiators in the SaaS market, appealing to environmentally conscious businesses.

These emerging SaaS technologies are paving the way for a smarter future characterized by greater efficiency and innovation.

Next-Generation User Experience

Voice and conversational interfaces are being integrated across platforms to provide more natural and efficient user interactions. These interfaces enable users to interact with complex software functionality using natural language, reducing training requirements and improving accessibility for users with varying technical backgrounds.

Personalized AI-driven user experiences adapt interface layouts, feature recommendations, and workflow suggestions based on individual user behavior and preferences. This personalization improves user productivity while reducing the complexity of feature-rich platforms by emphasizing the most relevant capabilities for each user.

Collaborative software evolution supports hybrid work models by providing seamless experiences across different devices, locations, and collaboration contexts. Modern collaborative platforms integrate real-time communication, project management, document collaboration, and workflow automation within unified environments that support diverse working arrangements.

Mobile-first design principles ensure that saas platforms provide full functionality and optimal user experiences on mobile devices rather than treating mobile access as a secondary consideration. This approach reflects the reality that many users primarily access business software through mobile devices and expect equivalent functionality across all platforms. The shift towards hybrid and remote work models has cemented the importance of collaboration software, which will evolve to include AI-driven features.

Market Predictions and Growth Trajectories

saas market projections reaching $829.3 billion by 2031 with a 13.7% CAGR reflect continued strong demand for cloud-based software solutions across all business sectors. This growth encompasses both traditional saas expansion and emerging categories like AI-native platforms, vertical solutions, and embedded integration services.

iPaaS market growth from current levels to $9 billion by 2025 underscores increasing recognition that integration capabilities are becoming essential infrastructure for modern businesses. This growth reflects expanding enterprise adoption of integration platforms and increasing sophistication of integration requirements as businesses adopt more complex saas ecosystems. iPaaS enables companies to connect their applications, business processes, and data in real-time, ensuring better performance and output across these interconnected systems.

Geographic expansion patterns show particularly strong growth in emerging markets where businesses are adopting cloud-first strategies without legacy on-premise infrastructure. These markets often leapfrog traditional software deployment models and adopt modern saas and integration approaches immediately, creating significant opportunities for platform providers.

M&A consolidation trends indicate that larger platform providers are acquiring specialized capabilities and vertical expertise rather than developing them internally. This strategy enables rapid expansion of platform capabilities while providing exit opportunities for specialized saas providers and micro saas businesses.

Investment and Funding Landscape

Venture capital trends in saas platform and integration technologies show continued strong investment interest, particularly in AI-native platforms, vertical saas solutions, and innovative integration approaches. Investors are prioritizing companies with strong integration capabilities and clear paths to platform expansion over pure-play point solutions.

Corporate investment in AI-native platform development reflects recognition that artificial intelligence capabilities will become essential competitive differentiators rather than optional features. Major saas companies are investing heavily in AI research and development while also acquiring specialized AI capabilities through strategic partnerships and acquisitions.

Strategic partnerships between saas vendors and integration providers are becoming increasingly important as companies recognize that comprehensive ecosystems require both deep platform capabilities and extensive integration support. These partnerships enable specialization while providing customers with complete solutions.

ROI expectations and measurement frameworks for integrated saas investments are evolving to account for the cumulative value of platform ecosystems rather than individual application benefits. Organizations are developing more sophisticated approaches to measuring software ROI that account for integration benefits, workflow automation value, and reduced complexity costs.

Preparing for the Future: Strategic Recommendations

IT leadership strategies for navigating the transition to unified platforms require comprehensive evaluation of current software portfolios, identification of consolidation opportunities, and development of migration roadmaps that minimize disruption while maximizing benefits. Successful transitions typically involve gradual migration strategies that prove value incrementally rather than attempting complete platform replacement simultaneously.

Vendor selection criteria should prioritize native-AI capabilities and integration roadmaps over individual feature comparisons. Organizations should evaluate platforms based on their ability to support future needs and integration requirements rather than current functionality alone. Integration capabilities often determine long-term platform value more than specific features.

Change management approaches for transitioning from point solutions to platforms require comprehensive training programs, clear communication about benefits, and support systems that help users adapt to new workflows. Successful platform transitions typically involve extensive user engagement and feedback collection to ensure that new platforms meet actual user needs.

Success metrics and KPIs for measuring platform integration effectiveness should include productivity improvements, reduced complexity costs, enhanced decision-making speed, and improved user satisfaction. Organizations should establish baseline measurements before platform transitions and track improvements across multiple dimensions rather than focusing solely on cost reductions.

Implementation Roadmap for 2025-2027

Organizations should begin evaluating current saas portfolios immediately to identify consolidation opportunities and integration gaps. This evaluation should assess not only current functionality but also future scalability requirements and integration complexity. Timeline for evaluation should be completed by mid-2025 to allow sufficient time for strategic planning and vendor selection.

Pilot program strategies for testing unified platform approaches should focus on specific business functions or departments that can demonstrate clear value while minimizing organization-wide disruption. Successful pilots provide proof-of-concept evidence that supports broader platform adoption decisions and help identify implementation best practices.

Training and skill development requirements for teams managing integrated platforms include both technical skills for managing more sophisticated systems and strategic skills for optimizing platform value. Organizations should invest in developing internal expertise in platform management, integration optimization, and AI-assisted workflows.

Risk mitigation strategies during transition from legacy integration models should include comprehensive backup plans, gradual migration approaches, and extensive testing protocols. Organizations should maintain redundant capabilities during transitions to ensure business continuity while implementing new platform approaches.

The future of saas platforms and integrations represents a fundamental transformation that will reshape how organizations approach technology investments, workflow management, and operational efficiency. Success in this new environment requires strategic thinking, careful planning, and commitment to continuous adaptation as the landscape continues evolving.

Organizations that begin preparing now for this transformation will gain significant competitive advantages through improved operational efficiency, enhanced decision-making capabilities, and reduced technology complexity. The time for strategic planning and vendor evaluation is now, as the window for gradual transition to next-generation platform approaches is narrowing rapidly.

SaaS Management in a Hyper-Integrated Era

The rapid evolution of the SaaS industry has ushered in an era where hyper-integration is not just a competitive advantage, but a necessity for business success. As organizations increasingly deploy multiple SaaS applications to support everything from project management to HR and customer engagement, the complexity of managing these interconnected tools has grown exponentially. This proliferation demands a new approach to SaaS management—one that prioritizes seamless integration, robust data security, and operational efficiency at every level.

SaaS companies are responding to this challenge by developing advanced integration capabilities that enable businesses to connect disparate systems with minimal friction. Modern SaaS management platforms now offer unified dashboards, automated workflow orchestration, and real-time monitoring of app usage and resource consumption across multiple SaaS applications. These tools empower IT teams to oversee the entire SaaS ecosystem, ensuring that data flows smoothly between different systems and that integration processes remain reliable and secure.

Seamless integration is at the heart of this transformation. By enabling businesses to automate processes and synchronize data across various platforms, SaaS providers are helping organizations eliminate data silos, reduce manual intervention, and accelerate decision-making. This not only enhances operational efficiency but also improves the overall customer experience by ensuring that information is always up-to-date and accessible where it’s needed most.

However, as integration deepens, data security becomes an even more critical concern. The risk of data breaches and unauthorized access increases as sensitive data moves between multiple SaaS applications. Leading SaaS companies are investing heavily in advanced security measures, including end-to-end encryption, granular access controls, and continuous monitoring for suspicious activity. These safeguards are essential for maintaining trust and compliance in a landscape where data is constantly in motion.

Effective SaaS management in this hyper-integrated era also involves proactive cost management and optimization. With SaaS spending on the rise, organizations must track software usage, eliminate redundant subscriptions, and ensure that each application delivers measurable value. SaaS management platforms provide the analytics and insights needed to make informed decisions about software investments, helping businesses maximize ROI while minimizing unnecessary expenses.

In summary, the future of SaaS management lies in the ability to orchestrate seamless integration, enforce rigorous data security, and drive operational efficiency across an ever-expanding ecosystem of SaaS applications. As the SaaS industry continues to evolve, organizations that master these capabilities will be best positioned to thrive in a connected, data-driven world.